Finite Markov Chains¶

In addition to what’s in Anaconda, this lecture will need the following libraries:

!conda install -y quantecon

Overview¶

Markov chains are one of the most useful classes of stochastic processes, being

- simple, flexible and supported by many elegant theoretical results

- valuable for building intuition about random dynamic models

- central to quantitative modeling in their own right

You will find them in many of the workhorse models of economics and finance.

In this lecture, we review some of the theory of Markov chains.

We will also introduce some of the high-quality routines for working with Markov chains available in QuantEcon.py.

Prerequisite knowledge is basic probability and linear algebra.

Let’s start with some standard imports:

import quantecon as qe

import numpy as np

from mpl_toolkits.mplot3d import Axes3D

import matplotlib.pyplot as plt

%matplotlib inline

Stochastic Matrices¶

A stochastic matrix (or Markov matrix) is an $ n \times n $ square matrix $ P $ such that

- each element of $ P $ is nonnegative, and

- each row of $ P $ sums to one

Each row of $ P $ can be regarded as a probability mass function over $ n $ possible outcomes.

It is too not difficult to check [1] that if $ P $ is a stochastic matrix, then so is the $ k $-th power $ P^k $ for all $ k \in \mathbb N $.

Markov Chains¶

There is a close connection between stochastic matrices and Markov chains.

To begin, let $ S $ be a finite set with $ n $ elements $ \{x_1, \ldots, x_n\} $.

The set $ S $ is called the state space and $ x_1, \ldots, x_n $ are the state values.

A Markov chain $ \{X_t\} $ on $ S $ is a sequence of random variables on $ S $ that have the Markov property.

This means that, for any date $ t $ and any state $ y \in S $,

$$ \mathbb P \{ X_{t+1} = y \,|\, X_t \} = \mathbb P \{ X_{t+1} = y \,|\, X_t, X_{t-1}, \ldots \} \tag{1} $$

In other words, knowing the current state is enough to know probabilities for future states.

In particular, the dynamics of a Markov chain are fully determined by the set of values

$$ P(x, y) := \mathbb P \{ X_{t+1} = y \,|\, X_t = x \} \qquad (x, y \in S) \tag{2} $$

By construction,

- $ P(x, y) $ is the probability of going from $ x $ to $ y $ in one unit of time (one step)

- $ P(x, \cdot) $ is the conditional distribution of $ X_{t+1} $ given $ X_t = x $

We can view $ P $ as a stochastic matrix where

$$ P_{ij} = P(x_i, x_j) \qquad 1 \leq i, j \leq n $$Going the other way, if we take a stochastic matrix $ P $, we can generate a Markov chain $ \{X_t\} $ as follows:

- draw $ X_0 $ from some specified distribution

- for each $ t = 0, 1, \ldots $, draw $ X_{t+1} $ from $ P(X_t,\cdot) $

By construction, the resulting process satisfies (2).

Example 1¶

Consider a worker who, at any given time $ t $, is either unemployed (state 0) or employed (state 1).

Suppose that, over a one month period,

- An unemployed worker finds a job with probability $ \alpha \in (0, 1) $.

- An employed worker loses her job and becomes unemployed with probability $ \beta \in (0, 1) $.

In terms of a Markov model, we have

- $ S = \{ 0, 1\} $

- $ P(0, 1) = \alpha $ and $ P(1, 0) = \beta $

We can write out the transition probabilities in matrix form as

$$ P = \left( \begin{array}{cc} 1 - \alpha & \alpha \\ \beta & 1 - \beta \end{array} \right) \tag{3} $$

Once we have the values $ \alpha $ and $ \beta $, we can address a range of questions, such as

- What is the average duration of unemployment?

- Over the long-run, what fraction of time does a worker find herself unemployed?

- Conditional on employment, what is the probability of becoming unemployed at least once over the next 12 months?

We’ll cover such applications below.

Example 2¶

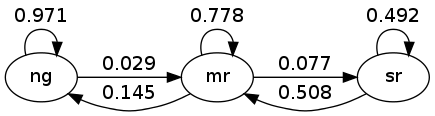

Using US unemployment data, Hamilton [Ham05] estimated the stochastic matrix

$$ P = \left( \begin{array}{ccc} 0.971 & 0.029 & 0 \\ 0.145 & 0.778 & 0.077 \\ 0 & 0.508 & 0.492 \end{array} \right) $$where

- the frequency is monthly

- the first state represents “normal growth”

- the second state represents “mild recession”

- the third state represents “severe recession”

For example, the matrix tells us that when the state is normal growth, the state will again be normal growth next month with probability 0.97.

In general, large values on the main diagonal indicate persistence in the process $ \{ X_t \} $.

This Markov process can also be represented as a directed graph, with edges labeled by transition probabilities

Here “ng” is normal growth, “mr” is mild recession, etc.

Simulation¶

One natural way to answer questions about Markov chains is to simulate them.

(To approximate the probability of event $ E $, we can simulate many times and count the fraction of times that $ E $ occurs).

Nice functionality for simulating Markov chains exists in QuantEcon.py.

- Efficient, bundled with lots of other useful routines for handling Markov chains.

However, it’s also a good exercise to roll our own routines — let’s do that first and then come back to the methods in QuantEcon.py.

In these exercises, we’ll take the state space to be $ S = 0,\ldots, n-1 $.

Rolling Our Own¶

To simulate a Markov chain, we need its stochastic matrix $ P $ and a probability distribution $ \psi $ for the initial state to be drawn from.

The Markov chain is then constructed as discussed above. To repeat:

- At time $ t=0 $, the $ X_0 $ is chosen from $ \psi $.

- At each subsequent time $ t $, the new state $ X_{t+1} $ is drawn from $ P(X_t, \cdot) $.

To implement this simulation procedure, we need a method for generating draws from a discrete distribution.

For this task, we’ll use random.draw from QuantEcon, which works as follows:

ψ = (0.3, 0.7) # probabilities over {0, 1}

cdf = np.cumsum(ψ) # convert into cummulative distribution

qe.random.draw(cdf, 5) # generate 5 independent draws from ψ

We’ll write our code as a function that takes the following three arguments

- A stochastic matrix

P - An initial state

init - A positive integer

sample_sizerepresenting the length of the time series the function should return

def mc_sample_path(P, ψ_0=None, sample_size=1_000):

# set up

P = np.asarray(P)

X = np.empty(sample_size, dtype=int)

# Convert each row of P into a cdf

n = len(P)

P_dist = [np.cumsum(P[i, :]) for i in range(n)]

# draw initial state, defaulting to 0

if ψ_0 is not None:

X_0 = qe.random.draw(np.cumsum(ψ_0))

else:

X_0 = 0

# simulate

X[0] = X_0

for t in range(sample_size - 1):

X[t+1] = qe.random.draw(P_dist[X[t]])

return X

Let’s see how it works using the small matrix

P = [[0.4, 0.6],

[0.2, 0.8]]

As we’ll see later, for a long series drawn from P, the fraction of the sample that takes value 0 will be about 0.25.

Moreover, this is true, regardless of the initial distribution from with $ X_0 $ is drawn.

The following code illustrates this

X = mc_sample_path(P, ψ_0=[0.1, 0.9], sample_size=100_000)

np.mean(X == 0)

You can try changing the initial distribution to confirm that the output is always close to 0.25.

Using QuantEcon’s Routines¶

As discussed above, QuantEcon.py has routines for handling Markov chains, including simulation.

Here’s an illustration using the same P as the preceding example

from quantecon import MarkovChain

mc = qe.MarkovChain(P)

X = mc.simulate(ts_length=1_000_000)

np.mean(X == 0)

The QuantEcon.py routine is JIT compiled and much faster.

%time mc_sample_path(P, sample_size=1_000_000) # Our version

%time mc.simulate(ts_length=1_000_000) # qe version

Adding State Values and Initial Conditions¶

If we wish to, we can provide a specification of state values to MarkovChain.

These state values can be integers, floats, or even strings.

The following code illustrates

mc = qe.MarkovChain(P, state_values=('unemployed', 'employed'))

mc.simulate(ts_length=4, init='employed')

mc.simulate(ts_length=4, init='unemployed')

mc.simulate(ts_length=4) # Start at randomly chosen initial state

If we want to simulate with output as indices rather than state values we can use

mc.simulate_indices(ts_length=4)

Marginal Distributions¶

- $ \{X_t\} $ is a Markov chain with stochastic matrix $ P $

- the distribution of $ X_t $ is known to be $ \psi_t $

What then is the distribution of $ X_{t+1} $, or, more generally, of $ X_{t+m} $?

To answer this, we let $ \psi_t $ be the distribution of $ X_t $ for $ t = 0, 1, 2, \ldots $.

Our first aim is to find $ \psi_{t + 1} $ given $ \psi_t $ and $ P $.

To begin, pick any $ y \in S $.

Using the law of total probability, we can decompose the probability that $ X_{t+1} = y $ as follows:

$$ \mathbb P \{X_{t+1} = y \} = \sum_{x \in S} \mathbb P \{ X_{t+1} = y \, | \, X_t = x \} \cdot \mathbb P \{ X_t = x \} $$In words, to get the probability of being at $ y $ tomorrow, we account for all ways this can happen and sum their probabilities.

Rewriting this statement in terms of marginal and conditional probabilities gives

$$ \psi_{t+1}(y) = \sum_{x \in S} P(x,y) \psi_t(x) $$There are $ n $ such equations, one for each $ y \in S $.

If we think of $ \psi_{t+1} $ and $ \psi_t $ as row vectors (as is traditional in this literature), these $ n $ equations are summarized by the matrix expression

$$ \psi_{t+1} = \psi_t P \tag{4} $$

In other words, to move the distribution forward one unit of time, we postmultiply by $ P $.

By repeating this $ m $ times we move forward $ m $ steps into the future.

Hence, iterating on (4), the expression $ \psi_{t+m} = \psi_t P^m $ is also valid — here $ P^m $ is the $ m $-th power of $ P $.

As a special case, we see that if $ \psi_0 $ is the initial distribution from which $ X_0 $ is drawn, then $ \psi_0 P^m $ is the distribution of $ X_m $.

This is very important, so let’s repeat it

$$ X_0 \sim \psi_0 \quad \implies \quad X_m \sim \psi_0 P^m \tag{5} $$

and, more generally,

$$ X_t \sim \psi_t \quad \implies \quad X_{t+m} \sim \psi_t P^m \tag{6} $$

Multiple Step Transition Probabilities¶

We know that the probability of transitioning from $ x $ to $ y $ in one step is $ P(x,y) $.

It turns out that the probability of transitioning from $ x $ to $ y $ in $ m $ steps is $ P^m(x,y) $, the $ (x,y) $-th element of the $ m $-th power of $ P $.

To see why, consider again (6), but now with $ \psi_t $ putting all probability on state $ x $

- 1 in the $ x $-th position and zero elsewhere

Inserting this into (6), we see that, conditional on $ X_t = x $, the distribution of $ X_{t+m} $ is the $ x $-th row of $ P^m $.

In particular

$$ \mathbb P \{X_{t+m} = y \,|\, X_t = x \} = P^m(x, y) = (x, y) \text{-th element of } P^m $$Example: Probability of Recession¶

Recall the stochastic matrix $ P $ for recession and growth considered above.

Suppose that the current state is unknown — perhaps statistics are available only at the end of the current month.

We estimate the probability that the economy is in state $ x $ to be $ \psi(x) $.

The probability of being in recession (either mild or severe) in 6 months time is given by the inner product

$$ \psi P^6 \cdot \left( \begin{array}{c} 0 \\ 1 \\ 1 \end{array} \right) $$Example 2: Cross-Sectional Distributions¶

The marginal distributions we have been studying can be viewed either as probabilities or as cross-sectional frequencies in large samples.

To illustrate, recall our model of employment/unemployment dynamics for a given worker discussed above.

Consider a large population of workers, each of whose lifetime experience is described by the specified dynamics, independent of one another.

Let $ \psi $ be the current cross-sectional distribution over $ \{ 0, 1 \} $.

The cross-sectional distribution records the fractions of workers employed and unemployed at a given moment.

- For example, $ \psi(0) $ is the unemployment rate.

What will the cross-sectional distribution be in 10 periods hence?

The answer is $ \psi P^{10} $, where $ P $ is the stochastic matrix in (3).

This is because each worker is updated according to $ P $, so $ \psi P^{10} $ represents probabilities for a single randomly selected worker.

But when the sample is large, outcomes and probabilities are roughly equal (by the Law of Large Numbers).

So for a very large (tending to infinite) population, $ \psi P^{10} $ also represents the fraction of workers in each state.

This is exactly the cross-sectional distribution.

Irreducibility and Aperiodicity¶

Irreducibility and aperiodicity are central concepts of modern Markov chain theory.

Let’s see what they’re about.

Irreducibility¶

Let $ P $ be a fixed stochastic matrix.

Two states $ x $ and $ y $ are said to communicate with each other if there exist positive integers $ j $ and $ k $ such that

$$ P^j(x, y) > 0 \quad \text{and} \quad P^k(y, x) > 0 $$In view of our discussion above, this means precisely that

- state $ x $ can be reached eventually from state $ y $, and

- state $ y $ can be reached eventually from state $ x $

The stochastic matrix $ P $ is called irreducible if all states communicate; that is, if $ x $ and $ y $ communicate for all $ (x, y) $ in $ S \times S $.

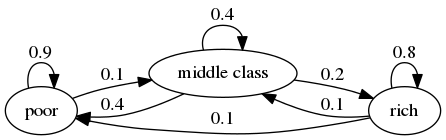

For example, consider the following transition probabilities for wealth of a fictitious set of households

We can translate this into a stochastic matrix, putting zeros where there’s no edge between nodes

$$ P := \left( \begin{array}{ccc} 0.9 & 0.1 & 0 \\ 0.4 & 0.4 & 0.2 \\ 0.1 & 0.1 & 0.8 \end{array} \right) $$It’s clear from the graph that this stochastic matrix is irreducible: we can reach any state from any other state eventually.

We can also test this using QuantEcon.py’s MarkovChain class

P = [[0.9, 0.1, 0.0],

[0.4, 0.4, 0.2],

[0.1, 0.1, 0.8]]

mc = qe.MarkovChain(P, ('poor', 'middle', 'rich'))

mc.is_irreducible

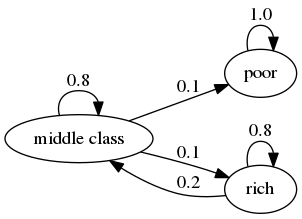

Here’s a more pessimistic scenario, where the poor are poor forever

This stochastic matrix is not irreducible, since, for example, rich is not accessible from poor.

Let’s confirm this

P = [[1.0, 0.0, 0.0],

[0.1, 0.8, 0.1],

[0.0, 0.2, 0.8]]

mc = qe.MarkovChain(P, ('poor', 'middle', 'rich'))

mc.is_irreducible

We can also determine the “communication classes”

mc.communication_classes

It might be clear to you already that irreducibility is going to be important in terms of long run outcomes.

For example, poverty is a life sentence in the second graph but not the first.

We’ll come back to this a bit later.

Aperiodicity¶

Loosely speaking, a Markov chain is called periodic if it cycles in a predictable way, and aperiodic otherwise.

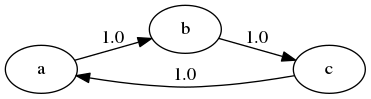

Here’s a trivial example with three states

The chain cycles with period 3:

P = [[0, 1, 0],

[0, 0, 1],

[1, 0, 0]]

mc = qe.MarkovChain(P)

mc.period

More formally, the period of a state $ x $ is the greatest common divisor of the set of integers

$$ D(x) := \{j \geq 1 : P^j(x, x) > 0\} $$In the last example, $ D(x) = \{3, 6, 9, \ldots\} $ for every state $ x $, so the period is 3.

A stochastic matrix is called aperiodic if the period of every state is 1, and periodic otherwise.

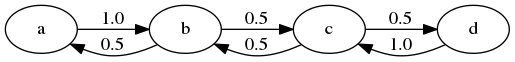

For example, the stochastic matrix associated with the transition probabilities below is periodic because, for example, state $ a $ has period 2

We can confirm that the stochastic matrix is periodic as follows

P = [[0.0, 1.0, 0.0, 0.0],

[0.5, 0.0, 0.5, 0.0],

[0.0, 0.5, 0.0, 0.5],

[0.0, 0.0, 1.0, 0.0]]

mc = qe.MarkovChain(P)

mc.period

mc.is_aperiodic

P = np.array([[0.4, 0.6],

[0.2, 0.8]])

ψ = (0.25, 0.75)

ψ @ P

Such distributions are called stationary, or invariant.

Formally, a distribution $ \psi^* $ on $ S $ is called stationary for $ P $ if $ \psi^* = \psi^* P $.

(This is the same notion of stationarity that we learned about in the lecture on AR(1) processes applied to a different setting.)

From this equality, we immediately get $ \psi^* = \psi^* P^t $ for all $ t $.

This tells us an important fact: If the distribution of $ X_0 $ is a stationary distribution, then $ X_t $ will have this same distribution for all $ t $.

Hence stationary distributions have a natural interpretation as stochastic steady states — we’ll discuss this more in just a moment.

Mathematically, a stationary distribution is a fixed point of $ P $ when $ P $ is thought of as the map $ \psi \mapsto \psi P $ from (row) vectors to (row) vectors.

Theorem. Every stochastic matrix $ P $ has at least one stationary distribution.

(We are assuming here that the state space $ S $ is finite; if not more assumptions are required)

For proof of this result, you can apply Brouwer’s fixed point theorem, or see EDTC, theorem 4.3.5.

There may in fact be many stationary distributions corresponding to a given stochastic matrix $ P $.

- For example, if $ P $ is the identity matrix, then all distributions are stationary.

Since stationary distributions are long run equilibria, to get uniqueness we require that initial conditions are not infinitely persistent.

Infinite persistence of initial conditions occurs if certain regions of the state space cannot be accessed from other regions, which is the opposite of irreducibility.

This gives some intuition for the following fundamental theorem.

Theorem. If $ P $ is both aperiodic and irreducible, then

- $ P $ has exactly one stationary distribution $ \psi^* $.

- For any initial distribution $ \psi_0 $, we have $ \| \psi_0 P^t - \psi^* \| \to 0 $ as $ t \to \infty $.

For a proof, see, for example, theorem 5.2 of [Haggstrom02].

(Note that part 1 of the theorem requires only irreducibility, whereas part 2 requires both irreducibility and aperiodicity)

A stochastic matrix satisfying the conditions of the theorem is sometimes called uniformly ergodic.

One easy sufficient condition for aperiodicity and irreducibility is that every element of $ P $ is strictly positive.

- Try to convince yourself of this.

Example¶

Recall our model of employment/unemployment dynamics for a given worker discussed above.

Assuming $ \alpha \in (0,1) $ and $ \beta \in (0,1) $, the uniform ergodicity condition is satisfied.

Let $ \psi^* = (p, 1-p) $ be the stationary distribution, so that $ p $ corresponds to unemployment (state 0).

Using $ \psi^* = \psi^* P $ and a bit of algebra yields

$$ p = \frac{\beta}{\alpha + \beta} $$This is, in some sense, a steady state probability of unemployment — more on interpretation below.

Not surprisingly it tends to zero as $ \beta \to 0 $, and to one as $ \alpha \to 0 $.

Calculating Stationary Distributions¶

As discussed above, a given Markov matrix $ P $ can have many stationary distributions.

That is, there can be many row vectors $ \psi $ such that $ \psi = \psi P $.

In fact if $ P $ has two distinct stationary distributions $ \psi_1, \psi_2 $ then it has infinitely many, since in this case, as you can verify,

$$ \psi_3 := \lambda \psi_1 + (1 - \lambda) \psi_2 $$is a stationary distribution for $ P $ for any $ \lambda \in [0, 1] $.

If we restrict attention to the case where only one stationary distribution exists, one option for finding it is to try to solve the linear system $ \psi (I_n - P) = 0 $ for $ \psi $, where $ I_n $ is the $ n \times n $ identity.

But the zero vector solves this equation, so we need to proceed carefully.

In essence, we need to impose the restriction that the solution must be a probability distribution.

There are various ways to do this.

One option is to regard this as an eigenvector problem: a vector $ \psi $ such that $ \psi = \psi P $ is a left eigenvector associated with the unit eigenvalue $ \lambda = 1 $.

A more stable and sophisticated algorithm is implemented in QuantEcon.py.

This is the one we recommend you to use:

P = [[0.4, 0.6],

[0.2, 0.8]]

mc = qe.MarkovChain(P)

mc.stationary_distributions # Show all stationary distributions

Convergence to Stationarity¶

Part 2 of the Markov chain convergence theorem stated above tells us that the distribution of $ X_t $ converges to the stationary distribution regardless of where we start off.

This adds considerable weight to our interpretation of $ \psi^* $ as a stochastic steady state.

The convergence in the theorem is illustrated in the next figure

P = ((0.971, 0.029, 0.000),

(0.145, 0.778, 0.077),

(0.000, 0.508, 0.492))

P = np.array(P)

ψ = (0.0, 0.2, 0.8) # Initial condition

fig = plt.figure(figsize=(8, 6))

ax = fig.add_subplot(111, projection='3d')

ax.set(xlim=(0, 1), ylim=(0, 1), zlim=(0, 1),

xticks=(0.25, 0.5, 0.75),

yticks=(0.25, 0.5, 0.75),

zticks=(0.25, 0.5, 0.75))

x_vals, y_vals, z_vals = [], [], []

for t in range(20):

x_vals.append(ψ[0])

y_vals.append(ψ[1])

z_vals.append(ψ[2])

ψ = ψ @ P

ax.scatter(x_vals, y_vals, z_vals, c='r', s=60)

ax.view_init(30, 210)

mc = qe.MarkovChain(P)

ψ_star = mc.stationary_distributions[0]

ax.scatter(ψ_star[0], ψ_star[1], ψ_star[2], c='k', s=60)

plt.show()

Here

- $ P $ is the stochastic matrix for recession and growth considered above.

- The highest red dot is an arbitrarily chosen initial probability distribution $ \psi $, represented as a vector in $ \mathbb R^3 $.

- The other red dots are the distributions $ \psi P^t $ for $ t = 1, 2, \ldots $.

- The black dot is $ \psi^* $.

You might like to try experimenting with different initial conditions.

Ergodicity¶

Under irreducibility, yet another important result obtains: For all $ x \in S $,

$$ \frac{1}{m} \sum_{t = 1}^m \mathbf{1}\{X_t = x\} \to \psi^*(x) \quad \text{as } m \to \infty \tag{7} $$

Here

- $ \mathbf{1}\{X_t = x\} = 1 $ if $ X_t = x $ and zero otherwise

- convergence is with probability one

- the result does not depend on the distribution (or value) of $ X_0 $

The result tells us that the fraction of time the chain spends at state $ x $ converges to $ \psi^*(x) $ as time goes to infinity.

This gives us another way to interpret the stationary distribution — provided that the convergence result in (7) is valid.

The convergence in (7) is a special case of a law of large numbers result for Markov chains — see EDTC, section 4.3.4 for some additional information.

Example¶

Recall our cross-sectional interpretation of the employment/unemployment model discussed above.

Assume that $ \alpha \in (0,1) $ and $ \beta \in (0,1) $, so that irreducibility and aperiodicity both hold.

We saw that the stationary distribution is $ (p, 1-p) $, where

$$ p = \frac{\beta}{\alpha + \beta} $$In the cross-sectional interpretation, this is the fraction of people unemployed.

In view of our latest (ergodicity) result, it is also the fraction of time that a worker can expect to spend unemployed.

Thus, in the long-run, cross-sectional averages for a population and time-series averages for a given person coincide.

This is one interpretation of the notion of ergodicity.

Computing Expectations¶

We are interested in computing expectations of the form

$$ \mathbb E [ h(X_t) ] \tag{8} $$

and conditional expectations such as

$$ \mathbb E [ h(X_{t + k}) \mid X_t = x] \tag{9} $$

where

- $ \{X_t\} $ is a Markov chain generated by $ n \times n $ stochastic matrix $ P $

- $ h $ is a given function, which, in expressions involving matrix algebra, we’ll think of as the column vector

The unconditional expectation (8) is easy: We just sum over the distribution of $ X_t $ to get

$$ \mathbb E [ h(X_t) ] = \sum_{x \in S} (\psi P^t)(x) h(x) $$Here $ \psi $ is the distribution of $ X_0 $.

Since $ \psi $ and hence $ \psi P^t $ are row vectors, we can also write this as

$$ \mathbb E [ h(X_t) ] = \psi P^t h $$For the conditional expectation (9), we need to sum over the conditional distribution of $ X_{t + k} $ given $ X_t = x $.

We already know that this is $ P^k(x, \cdot) $, so

$$ \mathbb E [ h(X_{t + k}) \mid X_t = x] = (P^k h)(x) \tag{10} $$

The vector $ P^k h $ stores the conditional expectation $ \mathbb E [ h(X_{t + k}) \mid X_t = x] $ over all $ x $.

Expectations of Geometric Sums¶

Sometimes we also want to compute expectations of a geometric sum, such as $ \sum_t \beta^t h(X_t) $.

In view of the preceding discussion, this is

$$ \mathbb{E} \left[ \sum_{j=0}^\infty \beta^j h(X_{t+j}) \mid X_t = x \right] = [(I - \beta P)^{-1} h](x) $$where

$$ (I - \beta P)^{-1} = I + \beta P + \beta^2 P^2 + \cdots $$Premultiplication by $ (I - \beta P)^{-1} $ amounts to “applying the resolvent operator”.

Exercises¶

Exercise 1¶

According to the discussion above, if a worker’s employment dynamics obey the stochastic matrix

$$ P = \left( \begin{array}{cc} 1 - \alpha & \alpha \\ \beta & 1 - \beta \end{array} \right) $$with $ \alpha \in (0,1) $ and $ \beta \in (0,1) $, then, in the long-run, the fraction of time spent unemployed will be

$$ p := \frac{\beta}{\alpha + \beta} $$In other words, if $ \{X_t\} $ represents the Markov chain for employment, then $ \bar X_m \to p $ as $ m \to \infty $, where

$$ \bar X_m := \frac{1}{m} \sum_{t = 1}^m \mathbf{1}\{X_t = 0\} $$The exercise is to illustrate this convergence by computing $ \bar X_m $ for large $ m $ and checking that it is close to $ p $.

You will see that this statement is true regardless of the choice of initial condition or the values of $ \alpha, \beta $, provided both lie in $ (0, 1) $.

Exercise 2¶

A topic of interest for economics and many other disciplines is ranking.

Let’s now consider one of the most practical and important ranking problems — the rank assigned to web pages by search engines.

(Although the problem is motivated from outside of economics, there is in fact a deep connection between search ranking systems and prices in certain competitive equilibria — see [DLP13].)

To understand the issue, consider the set of results returned by a query to a web search engine.

For the user, it is desirable to

- receive a large set of accurate matches

- have the matches returned in order, where the order corresponds to some measure of “importance”

Ranking according to a measure of importance is the problem we now consider.

The methodology developed to solve this problem by Google founders Larry Page and Sergey Brin is known as PageRank.

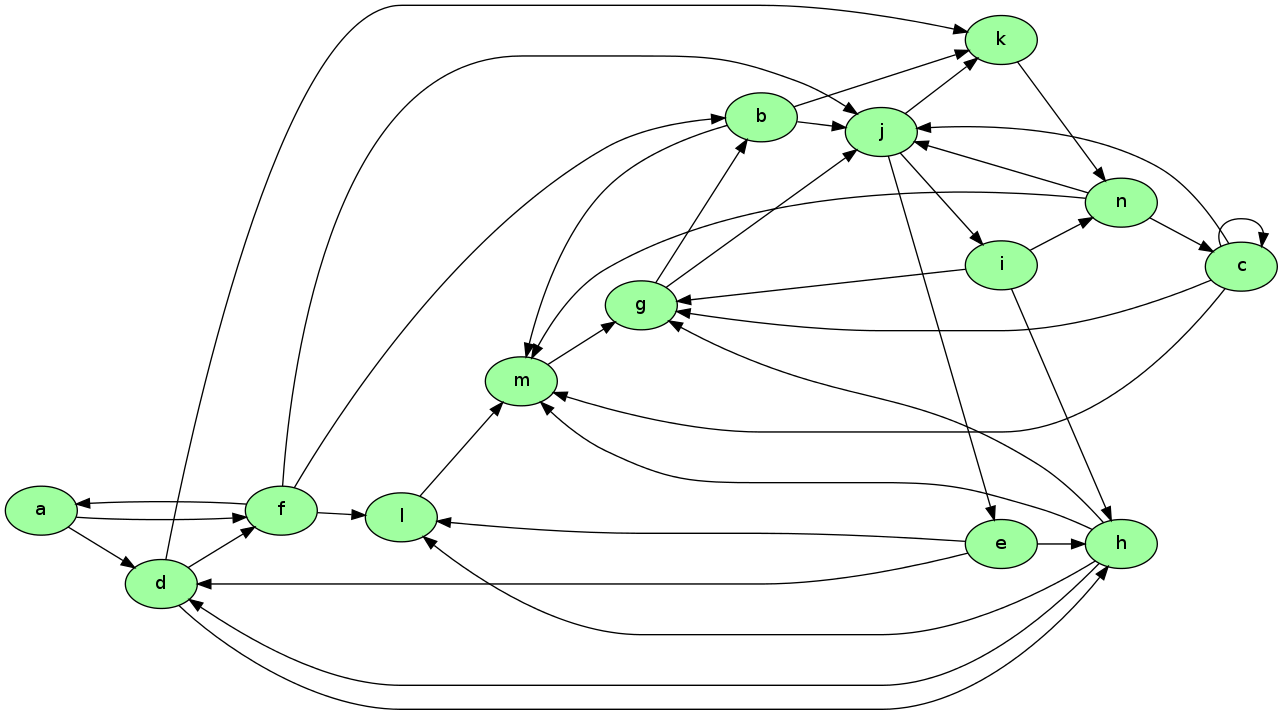

To illustrate the idea, consider the following diagram

Imagine that this is a miniature version of the WWW, with

- each node representing a web page

- each arrow representing the existence of a link from one page to another

Now let’s think about which pages are likely to be important, in the sense of being valuable to a search engine user.

One possible criterion for the importance of a page is the number of inbound links — an indication of popularity.

By this measure, m and j are the most important pages, with 5 inbound links each.

However, what if the pages linking to m, say, are not themselves important?

Thinking this way, it seems appropriate to weight the inbound nodes by relative importance.

The PageRank algorithm does precisely this.

A slightly simplified presentation that captures the basic idea is as follows.

Letting $ j $ be (the integer index of) a typical page and $ r_j $ be its ranking, we set

$$ r_j = \sum_{i \in L_j} \frac{r_i}{\ell_i} $$where

- $ \ell_i $ is the total number of outbound links from $ i $

- $ L_j $ is the set of all pages $ i $ such that $ i $ has a link to $ j $

This is a measure of the number of inbound links, weighted by their own ranking (and normalized by $ 1 / \ell_i $).

There is, however, another interpretation, and it brings us back to Markov chains.

Let $ P $ be the matrix given by $ P(i, j) = \mathbf 1\{i \to j\} / \ell_i $ where $ \mathbf 1\{i \to j\} = 1 $ if $ i $ has a link to $ j $ and zero otherwise.

The matrix $ P $ is a stochastic matrix provided that each page has at least one link.

With this definition of $ P $ we have

$$ r_j = \sum_{i \in L_j} \frac{r_i}{\ell_i} = \sum_{\text{all } i} \mathbf 1\{i \to j\} \frac{r_i}{\ell_i} = \sum_{\text{all } i} P(i, j) r_i $$Writing $ r $ for the row vector of rankings, this becomes $ r = r P $.

Hence $ r $ is the stationary distribution of the stochastic matrix $ P $.

Let’s think of $ P(i, j) $ as the probability of “moving” from page $ i $ to page $ j $.

The value $ P(i, j) $ has the interpretation

- $ P(i, j) = 1/k $ if $ i $ has $ k $ outbound links and $ j $ is one of them

- $ P(i, j) = 0 $ if $ i $ has no direct link to $ j $

Thus, motion from page to page is that of a web surfer who moves from one page to another by randomly clicking on one of the links on that page.

Here “random” means that each link is selected with equal probability.

Since $ r $ is the stationary distribution of $ P $, assuming that the uniform ergodicity condition is valid, we can interpret $ r_j $ as the fraction of time that a (very persistent) random surfer spends at page $ j $.

Your exercise is to apply this ranking algorithm to the graph pictured above and return the list of pages ordered by rank.

There is a total of 14 nodes (i.e., web pages), the first named a and the last named n.

A typical line from the file has the form

d -> h;

This should be interpreted as meaning that there exists a link from d to h.

The data for this graph is shown below, and read into a file called web_graph_data.txt when the cell is executed.

%%file web_graph_data.txt

a -> d;

a -> f;

b -> j;

b -> k;

b -> m;

c -> c;

c -> g;

c -> j;

c -> m;

d -> f;

d -> h;

d -> k;

e -> d;

e -> h;

e -> l;

f -> a;

f -> b;

f -> j;

f -> l;

g -> b;

g -> j;

h -> d;

h -> g;

h -> l;

h -> m;

i -> g;

i -> h;

i -> n;

j -> e;

j -> i;

j -> k;

k -> n;

l -> m;

m -> g;

n -> c;

n -> j;

n -> m;

To parse this file and extract the relevant information, you can use regular expressions.

The following code snippet provides a hint as to how you can go about this

import re

re.findall('\w', 'x +++ y ****** z') # \w matches alphanumerics

re.findall('\w', 'a ^^ b &&& $$ c')

Exercise 3¶

In numerical work, it is sometimes convenient to replace a continuous model with a discrete one.

In particular, Markov chains are routinely generated as discrete approximations to AR(1) processes of the form

$$ y_{t+1} = \rho y_t + u_{t+1} $$Here $ {u_t} $ is assumed to be IID and $ N(0, \sigma_u^2) $.

The variance of the stationary probability distribution of $ \{ y_t \} $ is

$$ \sigma_y^2 := \frac{\sigma_u^2}{1-\rho^2} $$Tauchen’s method [Tau86] is the most common method for approximating this continuous state process with a finite state Markov chain.

A routine for this already exists in QuantEcon.py but let’s write our own version as an exercise.

As a first step, we choose

- $ n $, the number of states for the discrete approximation

- $ m $, an integer that parameterizes the width of the state space

Next, we create a state space $ \{x_0, \ldots, x_{n-1}\} \subset \mathbb R $ and a stochastic $ n \times n $ matrix $ P $ such that

- $ x_0 = - m \, \sigma_y $

- $ x_{n-1} = m \, \sigma_y $

- $ x_{i+1} = x_i + s $ where $ s = (x_{n-1} - x_0) / (n - 1) $

Let $ F $ be the cumulative distribution function of the normal distribution $ N(0, \sigma_u^2) $.

The values $ P(x_i, x_j) $ are computed to approximate the AR(1) process — omitting the derivation, the rules are as follows:

If $ j = 0 $, then set

$$ P(x_i, x_j) = P(x_i, x_0) = F(x_0-\rho x_i + s/2) $$

If $ j = n-1 $, then set

$$ P(x_i, x_j) = P(x_i, x_{n-1}) = 1 - F(x_{n-1} - \rho x_i - s/2) $$

Otherwise, set

$$ P(x_i, x_j) = F(x_j - \rho x_i + s/2) - F(x_j - \rho x_i - s/2) $$

The exercise is to write a function approx_markov(rho, sigma_u, m=3, n=7) that returns

$ \{x_0, \ldots, x_{n-1}\} \subset \mathbb R $ and $ n \times n $ matrix

$ P $ as described above.

- Even better, write a function that returns an instance of QuantEcon.py’s MarkovChain class.

Solutions¶

Exercise 1¶

We will address this exercise graphically.

The plots show the time series of $ \bar X_m - p $ for two initial conditions.

As $ m $ gets large, both series converge to zero.

α = β = 0.1

N = 10000

p = β / (α + β)

P = ((1 - α, α), # Careful: P and p are distinct

( β, 1 - β))

P = np.array(P)

mc = MarkovChain(P)

fig, ax = plt.subplots(figsize=(9, 6))

ax.set_ylim(-0.25, 0.25)

ax.grid()

ax.hlines(0, 0, N, lw=2, alpha=0.6) # Horizonal line at zero

for x0, col in ((0, 'blue'), (1, 'green')):

# Generate time series for worker that starts at x0

X = mc.simulate(N, init=x0)

# Compute fraction of time spent unemployed, for each n

X_bar = (X == 0).cumsum() / (1 + np.arange(N, dtype=float))

# Plot

ax.fill_between(range(N), np.zeros(N), X_bar - p, color=col, alpha=0.1)

ax.plot(X_bar - p, color=col, label=f'$X_0 = \, {x0} $')

# Overlay in black--make lines clearer

ax.plot(X_bar - p, 'k-', alpha=0.6)

ax.legend(loc='upper right')

plt.show()

Exercise 2¶

"""

Return list of pages, ordered by rank

"""

import re

from operator import itemgetter

infile = 'web_graph_data.txt'

alphabet = 'abcdefghijklmnopqrstuvwxyz'

n = 14 # Total number of web pages (nodes)

# Create a matrix Q indicating existence of links

# * Q[i, j] = 1 if there is a link from i to j

# * Q[i, j] = 0 otherwise

Q = np.zeros((n, n), dtype=int)

f = open(infile, 'r')

edges = f.readlines()

f.close()

for edge in edges:

from_node, to_node = re.findall('\w', edge)

i, j = alphabet.index(from_node), alphabet.index(to_node)

Q[i, j] = 1

# Create the corresponding Markov matrix P

P = np.empty((n, n))

for i in range(n):

P[i, :] = Q[i, :] / Q[i, :].sum()

mc = MarkovChain(P)

# Compute the stationary distribution r

r = mc.stationary_distributions[0]

ranked_pages = {alphabet[i] : r[i] for i in range(n)}

# Print solution, sorted from highest to lowest rank

print('Rankings\n ***')

for name, rank in sorted(ranked_pages.items(), key=itemgetter(1), reverse=1):

print(f'{name}: {rank:.4}')

Exercise 3¶

A solution from the QuantEcon.py library can be found here.

Footnotes

[1] Hint: First show that if $ P $ and $ Q $ are stochastic matrices then so is their product — to check the row sums, try post multiplying by a column vector of ones. Finally, argue that $ P^n $ is a stochastic matrix using induction.